The Connection

The EVMOS Thesis

If it wasn’t clear by now, then let's make it clear — the future is a multi-chain one. Gone are the days when most people were confined to a single chain. Nowadays most people are using several chains to maximise yield, find new gems and much more.

So, let's take a deep dive into the world of EVMOS and what this means for interoperability, cross-chain communication and modularity.

Preface

Evmos currently does not have a token, but the highly anticipated airdrop and release are supposed to happen on February the 28th. So, take a seat, grab a coffee — and let's dig deep into Evmos to get prepared.

Intro

Let's start by establishing what EVMOS stands for — It's quite simple really, EVMOS is a play on EVMos and CosmOS.

And the name makes it quite clear what the mission of EVMOS is — to be an EVM connection to the Cosmos ecosystem. Before we dig super deep into the technical aspects of EVMOS let's take a look at why it’s so groundbreaking.

In a nutshell, what Evmos enables is integrating EVM compatible chains (so not just Ethereum) to Cosmos. This means that chains, such as Fantom, Avalanche and Harmony can integrate assets into the Cosmos IBC ecosystem through Evmos. That means EVM-based decentralized applications, tokens and NFTs can all be bridged to Cosmos.

However, and many of you might not know this, the idea for EVMOS was brought to life already in 2016, as Ethermint. The goal for Ethermint was to bring Tendermint's consensus protocol to Ethereum. This was realized with rollups such as Arbitrum, among others. Thus, there was no longer a value proposition for the original Ethermint chain.

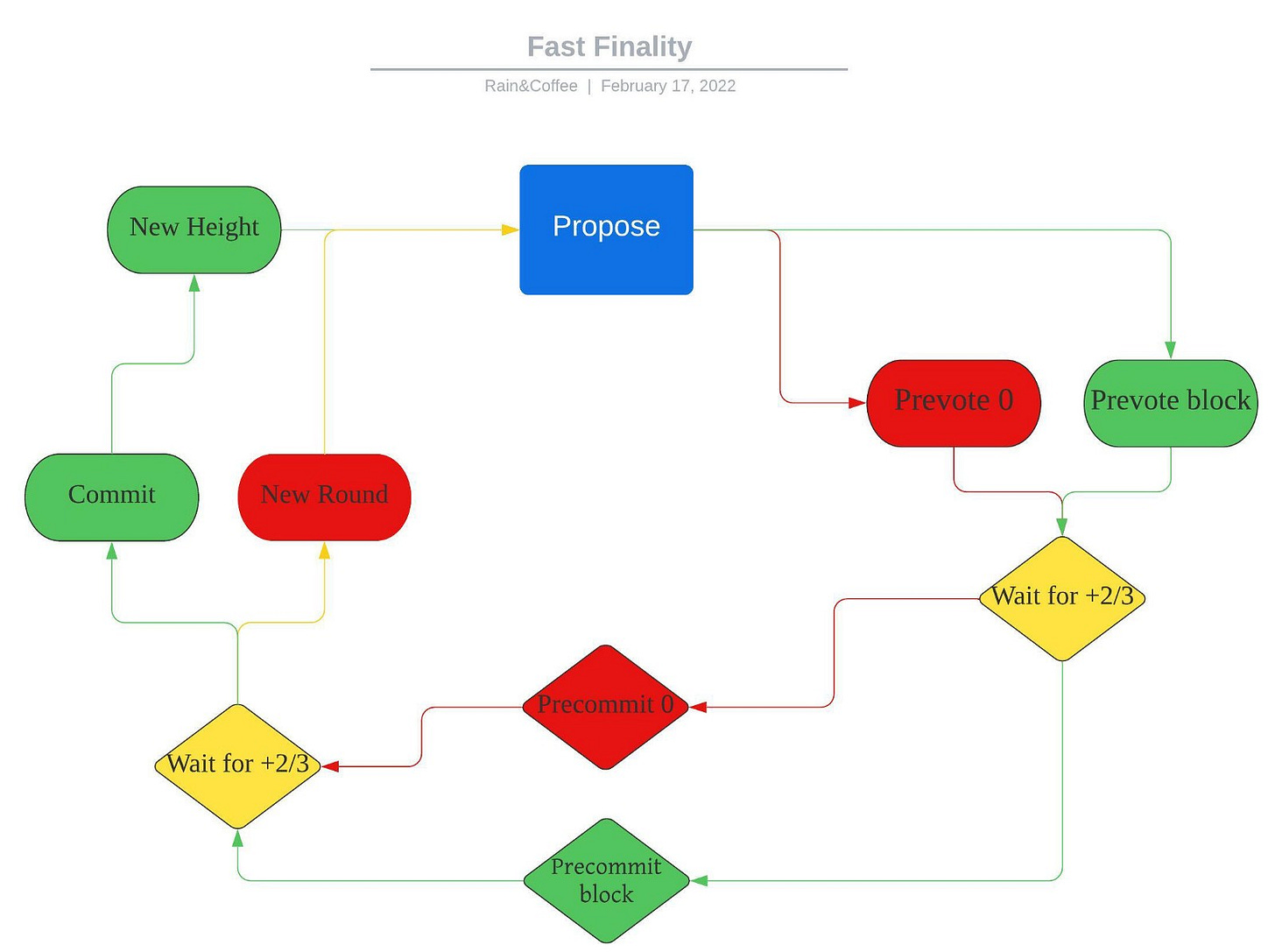

Consequently, the Tharsis team (responsible for Evmos) decided to work on their new vision — a highly secure, fast finality, EVM-based chain on Cosmos that could provide interoperability and greater composability for smart contracts between IBC and Ethereum.

Before we continue let's quickly establish what EVM and Finality stand for:

EVM is the virtual machine for Ethereum, which enables developers to build and create decentralized applications that work on Ethereum and Ethereum-like chains.

Finality is the assurance or guarantees that transactions cannot be altered, reversed, or cancelled after they are completed — Essentially, finality is the time it takes a network to confirm a transaction, thereby determining the chain's finality rate.

Unsurprisingly, fast finality has quickly accumulated a lot of traction in the Ethereum community, even Vitalik has written about the need for a Tendermint-like consensus model for Ethereum.

EVMOS

Now that we have established the background for Evmos, and the basic concepts - It is time to go more in-depth into the protocol, what it's trying to achieve, and much more.

Evmos will be a sovereign application-specific chain that will be interoperable with Ethereum, EVM-compatible environments, and other BFT chains via IBC, making it easy for users and developers to move between them. But the vision expands beyond that too, as Evmos plans to support the development of application-specific chains that utilize the Ethermint library (scalable and interoperable Ethereum library that can create PoS chains with fast-finality using the Cosmos SDK).

As a result, Evmos allows for running Ethereum as a Cosmos SDK application-specific blockchain. This allows for developers to have all the desired features of Ethereum, while at the same time, benefiting from Tendermint’s Proof-of-Stake consensus engine.

This means that Evmos enables:

EVM compatibility

High throughput via Tendermint's Consensus Engine

Horizontal scalability via IBC (performance increases by adding more nodes)

Fast transaction finality

Now you may be wondering, how is all this possible? This is possible because Evmos implements Tendermint, Cosmos SDK, as well as utilizing the go-Ethereum (geth) library (command-line interface for running Ethereum in Go(lang) — Which Cosmos SDK is written in). Now if that wasn't enough to make you excited, this next part surely will.

Evmos also enables a fully compatible JSON-RPC layer which means that Evmos can interact with existing Ethereum clients and tools such as Metamask.

As grazed upon earlier, Evmos will also enable users of IBC-enabled chains to access the type of protocols seen on Ethereum, including, but not limited to — decentralized exchanges, lending protocols, NFT applications, and much more.

So why should Ethereum-based applications deploy on Evmos?

Access to PoS consensus

Faster transactions

Lower Fees

The IBC userbase

To summarize, EVMOS will be the first IBC enabled EVM blockchain, built with Cosmos SDK and Tendermint as the consensus engine. This will allow new and existing EVM applications to integrate with Cosmos.

Here are some examples:

Aave has already proposed and voted for the implementation of Evmos, which means that there will be lending markets for Cosmos and Ethereum based assets on Evmos.

Furthermore, Evmos will also enable Osmosis to have pools with Ethereum assets, consequently, we might very well see Osmosis' goal of implementing a wide variety of financial instruments become reality soon.

Evmos facilitates the connection of over $100B in assets as well as a myriad of EVM based protocols, to connect to the Cosmos Hub, which will open up a new era for decentralized applications and finance in the IBC ecosystem.

Now that we have established the main focal points of what Evmos will bring to the table, let's take a look at some of the fundamental technical aspects:

Routing

For Evmos to be able to handle transactions for both EVM and Cosmos modules it has to be able to mimic Ethereum's transaction structure. It does this by emulating geth's transaction structure and treating it as a Cosmos SDK message type. In a single message, all the relevant Ethereum information is incorporated, such as signature, gas, amounts etc.

Pending State

On Ethereum, pending blocks are sired when they are queued for creation by miners. These blocks include pending transactions that are determined by miners, based on the highest gas reward.

Why is this? This is because, on Ethereum, block finality is not possible. Blocks are executed with what we call probabilistic finality, which means that transactions and as a result blocks become less likely to be reverted as more time passes by.

On the other hand, Evmos is designed quite differently as there is no concept of a “pending/probabilistic state”. This is because Evmos uses Tendermint consensus which provides instant(fast) finality for transactions. For this reason, Evmos does not require a pending state mechanism, as all transactions will be executed in the next block (currently, the average block time on Cosmos is around 8s, but it can get as low as 1s on Tendermint chains).

ERC-20 Module

Now, for Evmos to be able to handle and transact with EVM it needs an ERC-20 module.

The basis of the module is that it enables users to convert their ERC-20 tokens on Ethereum, into assets on Cosmos, and the other way around. This module thus enables interoperability between EVM and the Cosmos Hub.

The module also enables developers to write smart contracts that function on Evmos and to use EVM assets on other applications within the Cosmos ecosystem.

Also, since Evmos is also governed by the holders of the token, it will enable validators and applications to define fees in any ERC-20 token deployed on the Evmos chain.

After all that, you might have one question— how?

The module records affiliation between an ERC20-token contract address and a Cosmos token, this is known as a token pair. These token pairs then enable users to convert their ERC20 tokens into their Cosmos token representation, and vice versa. This means that the module translates the ERC20 token address into a Cosmos denomination or version.

To create new pairs, token holders of Evmos will have to create a governance proposal. If the governance proposal passes, the token pair will then be added to the module. When this happens, anyone can then convert that ERC20 token into its Cosmos counterpart.

This module, therefore, enables developers to build applications that experiment and innovate with multi-chain composability between application-specific blockchains.

Token (-omics)

Finally, we've arrived at what, to many, might be the most interesting part of this entire article, the Evmos token — and its functionality.

On blockchains, there are typically three actors: Developers, Users, and Block proposers (Validators or Miners). Every single actor has an important role in creating and maintaining value for the network

However, a lot of chains have fallen short of accruing sustainable value equally to these three important actors. Generally, block proposers accumulate the biggest stake of a network while users and developers — are left with less, despite being a lot more prevalent and active in the network.

So, how do we try to right this wrong?

In the case of Evmos, this is how they plan to rectify this:

Evmos will work not just as a fee and staking token, but it will be the first token on an EVM that drives governance outcomes for the chain. Furthermore, it may also assist to determine future economic developments that connect and benefit the three main actors.

To help further this cause, there are five primary use cases at launch:

Paying developers and network operators

Voting on protocol upgrades

Registering tokens on the ERC20 module

Deciding usage incentives for applications build on Evmos

Enabling high priority functionality

These usage incentives will further be added upon, as validators and holders vote on incentives to accrue more value to token holders.

Evmos hopes that this will cause a domino effect, as seen above.

Genesis

At launch, on the 28th, 40% of the initial supply of 200 million tokens will be airdropped (Rektdrop). The other 60% are committed to the community pool & strategic reserve, which will function as an accelerator for the Evmos ecosystem.

Inflation

In the first year, another 300M tokens will be issued, this means that Evmos is highly inflationary. Inflation will decrease year by year in an exponential decay schedule.

This is similar to half-life, which you might remember from physics class (radiation decay etc)

Target

After 4 years Evmos will reach the end of the distribution, and thereafter the token holders can vote for further distribution methods or a cap of token issuance.

As with other Tendermint and Cosmos SDK chains, the unbonding period of tokens will be 3 weeks, if you decide to stake them.

Fees/Gas

On Ethereum most of the token's value accrual comes from the despondent gas fees, however, on Tendermint chains, gas fees are usually minimal.

However, since Evmos is an EVM-compatible chain, it must also be able to impartially match gas consumption with other EVMs.

Therefore, to do so, the gas consumption logic from Cosmos SDK is ignored, and instead the gas consumed is calculated by deducting the state transition(confirming the transaction’s validity) leftover gas plus a refund from the gas limit.

Although, on Evmos it is possible to send transactions with minimal to zero fees, but only for transactions that aren't using the EVM module.

Consequently, EVM module transactions cannot have zero fees, as gas is required by the EVM.

CEVMOS

Another thing I'm extremely excited about is the partnership between Celestia and Evmos(you should be aware of this if you've read my Celestia piece), which will allow for a modular stack for EVM based applications using Celestia as a data availability layer.

This will enable extremely efficient EVM-based rollups with incredible scalability and security to function within the Cosmos Hub.

How the stack of modular chains will look like in practice:

CEVMOS will be optimized exclusively for rollups. As a consequence, rollups won’t have to compete for gas with non-rollup transactions, resulting in lower fees and better scalability. Since it is built with Cosmos SDK and Optimint it will be connected via IBC to the Evmos Hub and will utilize the Evmos token for security and gas.

This should in practice accrue even more value to the Evmos token.

Partnerships

The Evmos team has been hard at work establishing partnerships with a variety of protocols to grow the ecosystem, even before the official launch. They've secured partnerships with teams creating AMMs, Bridges and much more, let's take a look at what their partners are trying to achieve on Evmos.

Some of the major, and most exciting protocols that have committed to launching on Evmos are:

Aave, Diffusion (Uniswap fork), NovaDAO (Ohm fork), Frax (algorithmic stable coin), Metalancer (Balancer fork), Gamify (NFT marketplace)

Now, there are many more protocols that will build on Evmos, and I'm sure there are more to come.

Updates on new partnerships and projects building on Evmos can be found at evmos.blog.

Furthermore, Evmos will also be able to act as a settlement layer hub for multi-chain transactions. This will become possible via their newly announced partnership with @nomadxyz and @ConnextNetwork.

Here’s how it’s going to work:

This will be an Ethereum & Cosmos Hub based bridge at launch, that will enable ERC-20 tokens bridging to Cosmos.

Airdrop and Release

As mentioned earlier, to distribute tokens at launch Evmos has decided to follow in the footsteps of many other Cosmos protocols, by airdropping a significant part of the genesis supply.

The airdrop will consist of 80m Evmos tokens that will be dropped to a myriad of users based on various parameters.

These parameters range from users that have been rugged, used protocols, and helped secure networks both on Cosmos and Ethereum.

This is extremely unique, and also helps spread out the genesis supply, to increase fairness.

So where will you be able to buy Evmos at launch on the 28th? At launch, there will be several DEXs on Evmos where you'll be able to trade and swap.

Here are two of them:

Exswap

Exswap has confirmed that it will go live right as the Evmos token launches, so that's one of the places where you'll be able to buy immediately (Uniswap v2 fork).

Diffusion

Diffusion is also a Uniswap v2 fork. It’ll be one of the first AMMs for Evmos.

There has been no information as to whether or not Evmos will be available on a CEX at launch, however, I have to assume not — as the majority of the tokens will be airdropped to users, not exchanges.

So, unless the team uses part of their strategic allocation to provide exchange listings, your best bet to buying Evmos, will be on a Cosmos based DEX.

Conclusion

Evmos’ objective is to bridge EVM-based applications and assets to the interoperable Cosmos ecosystem while aligning developer and user incentives, as they strive to innovate interchain composability.

References

https://ethresear.ch/t/a-model-for-cumulative-committee-based-finality/10259

https://tokens-economy.gitbook.io/consensus/chain-based-pbft-and-bft-based-proof-of-stake

https://github.com/ethereum/go-ethereum

https://governance.aave.com/t/deploy-aave-v3-on-evmos/7149

https://github.com/tharsis/ethermint

https://evmos.dev/core/pending_state.html

https://evmos.blog/introducing-evmos-erc20-module-f40a61e05273

https://evmos.blog/the-evmos-token-model-edc07014978b

Will there be USDC/USDT availability on Cosmos with the EVM launch or it will need some more time?

Thanks for the write-ups.. i thoroughly enjoy your substack.

With 40% initial token distributed to airdrop, looks like a significant sell pressure will come in despite the upcoming (potentially value accruing) launch of Celestia.

From an investment perspective, seems like we will get a structural selling pressure?