“Arguing that you don’t care about the right to privacy because you have nothing to hide is no different than saying you don’t care about free speech because you have nothing to say” - Edward Snowden

Before we can delve deeper into Shade, we must first understand the network that makes Shade possible - Secret Network.

Secret Network

The first blockchain with privacy-preserving smart contracts

Smart contracts are self-executing pieces of code that are managed on a blockchain. Most smart-contract supported blockchains are public by default, meaning the data used in their smart contracts are exposed to the public. While a public record of blockchain data has several advantages, such as convenience in auditing and tracking, visible smart contract terms (i.e., allows users to see what's inside a smart contract before signing or interacting with it), and the ability for public scrutiny [1], privacy-preserving smart contracts still serve a crucial purpose.

Secret Network adapts traditional smart contracts by supporting encrypted inputs, encrypted outputs, and encrypted state for smart contracts - providing data privacy for sensitive information stored on the blockchain. Important to note, the native coin of Secret Network ($SCRT) is public, and therefore its transactions are visible on the public blockchain. Privacy-preserving Secret Tokens (i.e., $sSCRT) are private by default, encrypted to ensure anonymity and confidentiality. These tokens require ‘viewing keys’ to view their sensitive data. Viewing keys are controlled by the user, but can be shared. This allows users and developers to maintain control over their data and decide what is shared - and with who [2].

That sounds interesting, but how does it work?

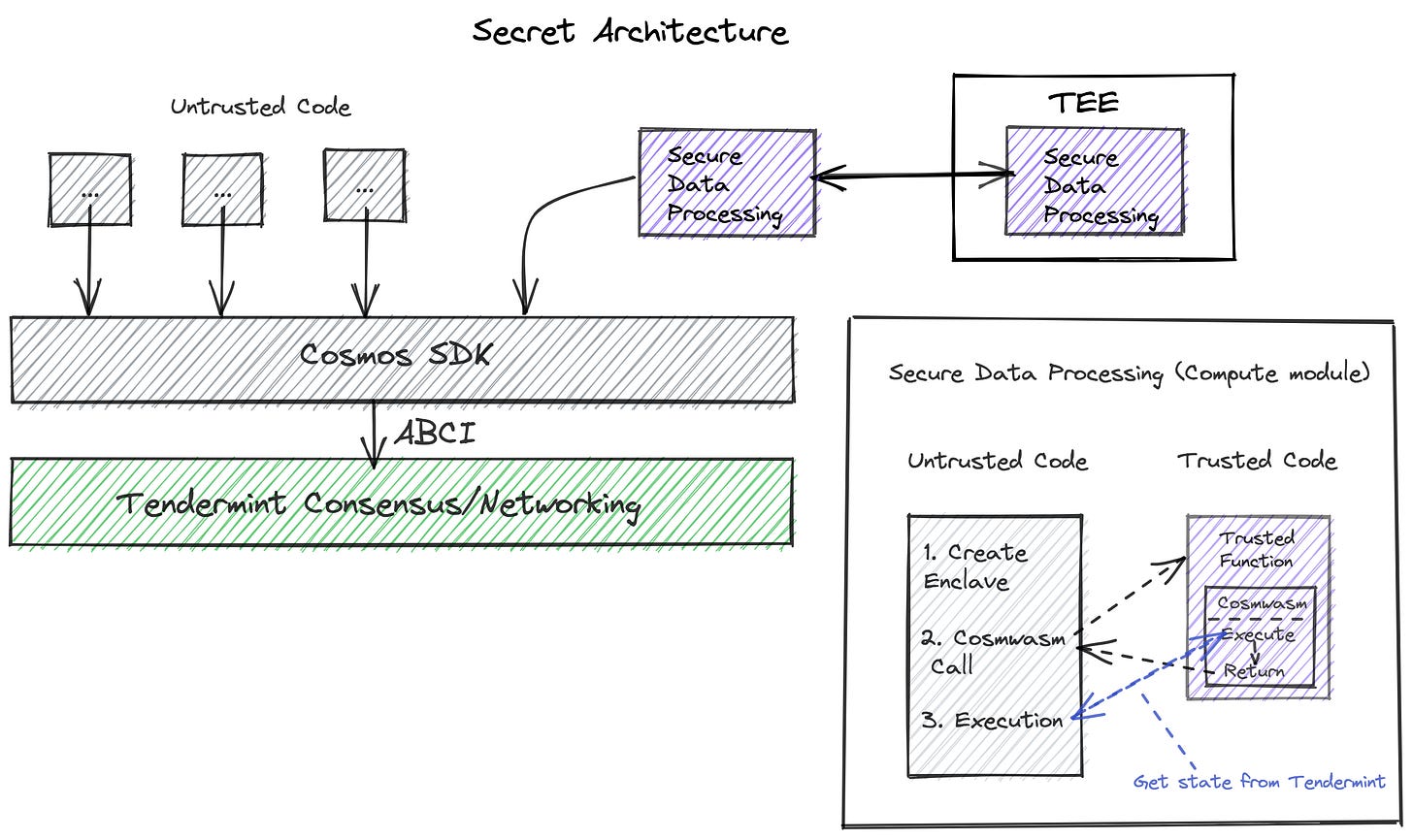

Secret Network is a Layer-1 Tendermint Blockchain built with the Cosmos SDK, enabling connection to other Cosmos IBC protocols. A key feature of Secret Network is its ability to enable data privacy. This is achieved through three key technologies - key management, encryption protocols, and Trusted Execution Environments (TEEs), which all validator nodes are required to possess.

TEEs (Trusted Execution Environments) are used to conceal data from the network. Rather than letting specific organizations manage private data, Secret relies on a decentralized network of secure processors. Every node operator is equipped with specialized hardware that allows them to run code inside secure enclaves. Nobody, including node operators, can access the raw information being decrypted and processed.

This can only be achieved by enabling the wrapping of tokens into a private equivalent token (SNIP-20) via a Secret Contract (think smart contract, but secret).

Secret Contracts enable encrypted input, state, and output to be executed. Therefore enabling messages and data to be encrypted by the user. Thanks to TEE, outputs that are encrypted are only known to the transaction sender and to the contract itself.

This leads to a principle opportunity unique to the Secret Network - programmable privacy.

If cryptocurrency is to become adopted by the masses, a certain degree of privacy is required in our daily transactions and activity.

It is difficult to picture a future where an individual (or organisation) will remain content in having their purchasing activity viewable by anyone with their wallet address. Similarly, the ability to control access to who can view these private tokens is necessary for future compliance in a blockchain-powered financial world.

The most vital reason why privacy should be a right, is that it enables people to determine what our information is used for and how it is handled - especially by large businesses. Controlling your privacy, therefore, enables us to safely and secretly maintain self-determination.

Therefore, let us introduce the focus of this article - Shade Protocol and its algorithmic stablecoin Silk.

Shade Protocol

What is Shade Protocol?

Shade Protocol is an array of connected, privacy-preserving decentralised finance applications.

What problem does Shade Solve? Why is Shade unique?

If you’ve been in DeFi for any meaningful length of time, you would’ve noticed a common trend among new protocols. When a new platform gains public traction, there is a core set of common decentralised applications (Dapps) that follow it. Typically, this would include:

Stablecoins

Synthetics

Insurance

Lending and borrowing

Decentralised Exchanges (DEXs)

Etc.

These core DeFi Dapps are needed for each protocol to effectively function as a financial service. When first introduced on Ethereum, these Dapps were innovative; now, they’re the standard. In fact, new protocols are considered incomplete unless they have them. The issue from a blockchain developer perspective is that each new Dapp has its own native token. This will typically lead to fractured attention (i.e., focus away from the native blockchain coin), inefficient systems, and the added opportunity cost from not having a cohesive and connected ecosystem of DeFi Dapps. Shade aims to solve this problem by becoming the first set of connected privacy-preserving DeFi applications, built on Secret Network [3].

So what does this mean?

Instead of each new application on a protocol creating a new token, all Dapps that are part of the Shade suite of applications will accrue value entirely to the Shade treasury and Shade stakers. Similarly, the Shade token will act as the single, universal governance token. Additionally, all of these protocols will live within the same portal on the Shade Protocol website. As a user, this drastically simplifies the DeFi user experience, creating a system whereby all your DeFi Dapps live in a single, unified web application. Remember, the goal is to make DeFi accessible to all - not only to crypto natives.

So what’s the first Dapp on Shade Protocol?

Silk! Let’s explore what makes this innovation so special.

Silk

Silk ($SILK) is the world’s first native privacy-preserving burn-based algorithmic stablecoin backed by a basket of global currencies and commodities [4].

That’s a lot of words, but what does it actually mean?

To begin, we must first understand the evolution of stablecoins.

[5].

While Tether has been useful in solving liquidity issues, it brings a key fundamental issue that blockchain was intended to solve into the space (i.e., a lack of decentralisation). DAI was created to solve this centralisation issue (although it is still relatively centralised). However, it brought its own unique problem - namely, during contractionary (and sometimes expansive) market events (i.e., market volatility), DAI can lose its Peg to the $USD when the collateral which backs DAI (principally ETH) is liquidated [6]. TerraUSD’s algorithmically pegged stablecoin design allows for dynamic adjustments to market forces in real-time, allowing it to better maintain its peg during market volatility. Despite its success, it does contain inflationary mechanics and a lack of transactional privacy. Therefore, Shade Protocol’s goal was to create a privacy-preserving stablecoin that contains similar mechanisms to TerraUSD, but without the inflationary mechanics attached. This stablecoin is called Silk.

Now that we know the history, why is silk special?

Instead of being pegged to a sovereign currency prone to inflation (i.e., the US dollar), Silk will be pegged to a basket of global currencies and commodities. This makes Silk the most stable currency ever created (at least according to Shade). This is important, as it allows users to better retain their purchasing power over time, by protecting against the negative effects of inflation and volatility.

Silk also has a set of unique tokenomics (see the section on Dual Tokenomics below for clarification and explanation).

It is privacy-preserving, meaning the user has control over who can view their sensitive financial data.

Silk will also be interoperable with other IBC blockchains (such as Atom, Juno, and Osmosis).

Dual-Tokenomics

When analysing a new crypto protocol, one of the most important factors to consider is the project’s tokenomics. The tokenomics of a project has the power to dictate the future of the protocol. Healthy tokenomics allow for value accrual to its holders, while ensuring that the protocol maintains a long-term vision. Conversely, negative tokenomics doom the protocol to a slow, faltering death. So, where do the tokenomics of Shade fall? Let's take a closer look at the dual-tokenomics of the $SHD and $SILK tokens.

Shade ($SHD) [7]

SHD will function as the governance token of Shade Protocol, whereby SHD holdings will be used to determine voting power for governance proposals.

It has inherent value, given its use in the mint/burn mechanics in the creation of Silk.

Shade Protocol aims to create a variety of other financial products where the SHD token will play a crucial role.

SHD will also help govern the ShadeDAO - and by extension, its treasury, which has a wide range of asset accrual and distribution mechanisms. The balance sheet of assets controlled by Shade Protocol governance will be used to stabilize the value of Silk while generating sustainable yield for SHD stakers.

SHD has an unbonding period of 21 days, similar to the rest of the Cosmos ecosystem.

Silk ($SILK) [4]

Minting

There are two ways to mint Silk.

DAO Entry - Depositing 1$ worth of sSCRT to mint 1 SILK

Burning - Burning 1$ of Shade to mint 1 SILK.

Peg

The process of burning in tandem with exchange arbitrage is what helps maintain Silk’s peg during rapid periods of supply and demand expansion and contraction.

Expansion: If the price of Silk is trading above 1$, to resolve the peg disparity an increase in the supply of Silk must occur. Here, exchange arbitrage will take over. People hunting +EV will burn SHD at 1$ to mint Silk - that in this case, can be swapped for other assets at a value of over 1$. This causes sell pressure on Silk and acts to re-peg the price of Silk to 1$.

Contraction: If the price of Silk is trading below 1$, to resolve the peg disparity a decrease in the supply of Silk must occur. This causes arbitrage hunters to perform the opposite of what was described above (i.e., situations of rapid expansion), thereby acting to re-peg the price of Silk to 1$.

Sustainability

Value enters the Silk and Shade ecosystem through two avenues:

Fiat -> SCRT -> sSCRT -> Shade, or

Fiat -> SCRT -> sSCRT -> Silk.

In the future, other assets (such as IBC enabled Secret Tokens) could be burned as well. Shade collateralizes Silk because 1 Silk can always be exchanged for $1 worth of Shade

Volatility Shock Absorption through Global Currency Basket

Silk aims to solve the volatility and sovereign currency risk of single fiat currency stablecoins. This is achieved by pegging Silk to a basket of global currencies used by the top 20 largest economies, with weights determined by relative GDP.

This creates lower volatility (than other fiat currencies and stablecoins), relative stability, bank independence, and immunity to any single sovereign currency's monetary risks.

Important to note, Silk has the ability to add additional commodities and currencies to the peg via Shade Protocol governance. Therefore, Silk will not be tied to a single configuration in perpetuity.

This will, of course, be subject to heavy scrutiny and regulation (if it ever happens). However, Silk is uniquely positioned given it is neither a reserve currency nor is it directly tied to a single sovereign currency. Because Silk is not directly pegged to any given sovereign currency, it lives firmly outside the majority of regulatory scrutiny as Silk is not an underlying fiat derivative.

This means, unlike other algorithmic stablecoins, $SILK can be kept to its peg and minted by other tokens - and eventually a basket of currencies, rather than just the governance token of the protocol.

Synthetics

One of the projects planned for Shade is a synthetics protocol. This synthetics asset protocol will, when finished, be the first privacy-preserving synthetics protocol ever created. So what does this mean? It means that anyone with access to Shade can mint and trade other synthetic assets, all while preserving their privacy. To track the price of real-world assets, Shade will use Band Protocol (an oracle service - think Chainlink).

Similar to the Silk/Shade peg mechanism, any real-world value can be tied to a synthetic token that tracks its value (as long as there is a stabilizer token that can respectively balance it). The value of the stabilizer token is determined by the free market and is ultimately a reflection of the value of the arbitrage profits that can be obtained with the stabilizer token.

Additionally, a % of assets from a burn-based entry will be sent to the Shade Treasury. In order to safely launch a new Synthetic asset, the stabilizer price needs to first be established.

Token Allocations

Now that we have looked at the intricate tokenomics of both the $SHD and $SILK token, let's take a look at the token allocations of SHD:

Why would I stake my $SHD?

To incentivize $SHD staking, the 10-year Osmosis-based thirdening model is used, with 12.36% of the $SHD supply going to stakers. Other sources of non-inflationary rewards for stakers will also be enabled, such as via:

Treasury bonds

The synthetics market

SCRT staking from the treasury

$SHD← →$SILK swap fees

$SILK transaction fees

Staking derivatives

Etc.

Furthermore, $SHD staking collateral is deposited into an arbitrage contract to help maintain the Silk peg (similar to how LUNA plans to collateralize UST through other ways than just mint/burn mechanics).

Private Raise

The private raise releases tokens using a linear vesting schedule over the course of 24 months, unlocking ~1,061 SHD per day spread across 25 different organizations and individuals (averaging 42.44 SHD per investor per day). This is not particularly vulture-like, but honestly a rather decent vesting schedule for a private raise - especially when you compare it to other projects (Hint: Solana Ecosystem).

Concluding Tokenomics Thoughts

While the tokenomics of the dual-tokens (i.e., SHD / SILK) seem great - and there's actual value accrual to the SHD token, the delegation of tokens at its FDV isn't particularly decentralized. With a large number of assets delegated to the company/DAO itself. There's also the added issue of a private raise. However, in this day and age - that's almost always to be expected.

In saying this, we have already seen large development funds work out well for other projects. This is because it helps in the development of a vibrant and expansive ecosystem of projects and users - since the protocol can fund various projects that help spark builder and user adoption [8].

Comparison

Whenever any protocol involves the interplay between a stablecoin and its staking/governance token, one's thoughts immediately flock to the relationship between LUNA and TERRA(various stablecoins). This section will serve as a comparison between the interplay of LUNA/TERRA and SHD/SILK. We will also look at the hypothetical possibilities for how SHD and SILK can develop in the future - with dApps similar to Anchor.

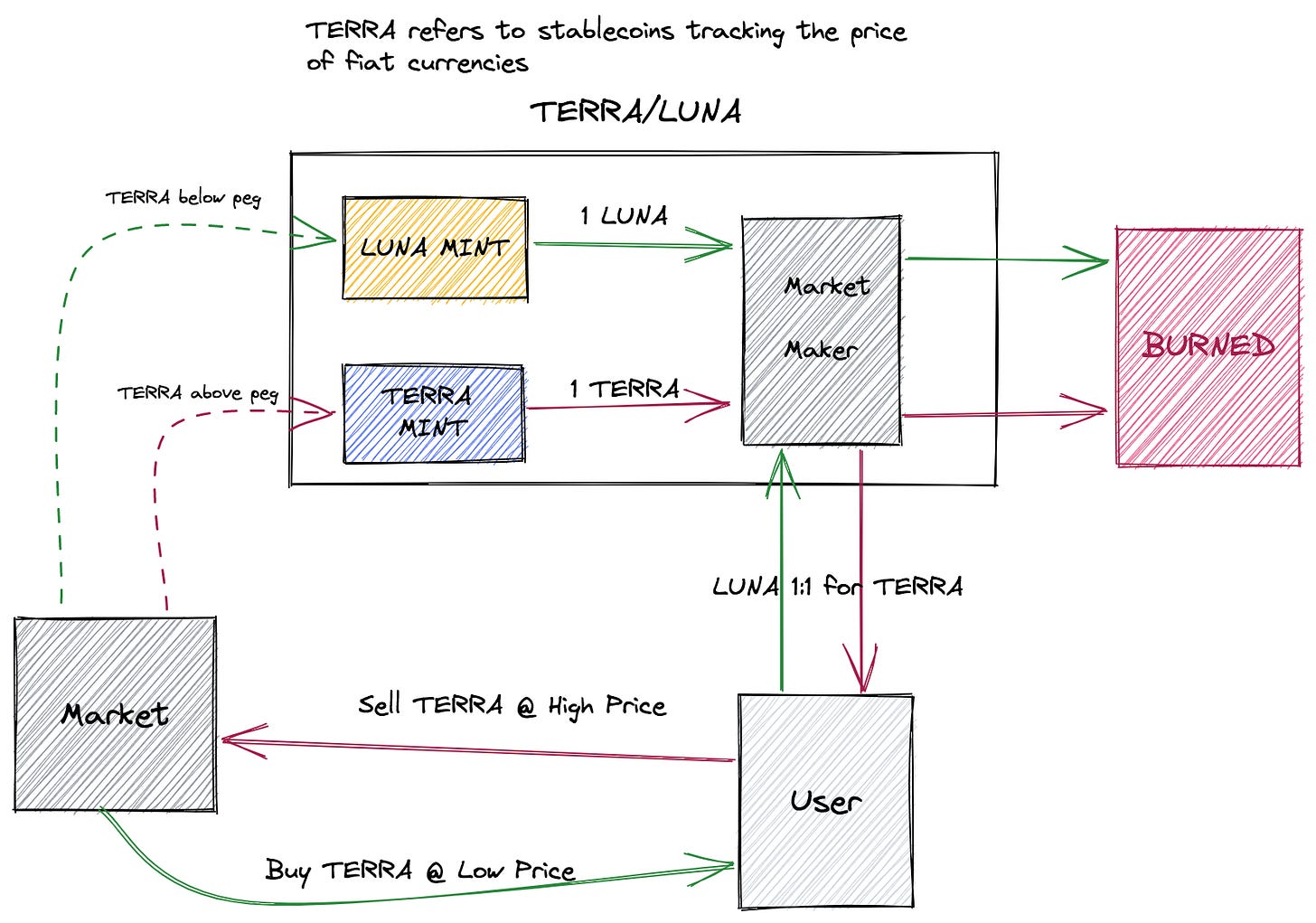

Similar to SHD/SILK, the pegging and minting mechanisms of LUNA/TERRA work almost identically. Let's look at the pegging mechanism so that we can see the similarities on paper.

A major difference, for now, is that LUNA can also be minted/pegged to various other fiat currencies - such as; KRW, MNT etc.

Furthermore, another difference is the seigniorage of LUNA. In which the protocol makes a profit by issuing the various currencies. For example, if the protocol mints 1 TERRA, it costs nothing. However, the protocol receives 1 LUNA in return - which is then burned. All seigniorage in the Terra protocol is burned, making Luna deflationary in nature. While on Shade Protocol, SHD and SILK are swapped.

Although, the contraction and expansion mechanics work similarly to Shade, as LUNA is also used as the reserve token to control the supply, like with SHD. Likewise, LUNA is also used as a governance token and in staking, to reward validators.

Therefore, we can conclude that SHD and LUNA work as variable counterparts to their respective stable assets. By modulating supply, LUNA and SHD's prices increase as the demand for stablecoins does. [9]

Anchor

One of the more fascinating dApps built on Luna is without a doubt, Anchor. Let's take a look at how Anchor works, and how we hypothetically could make a similar dApp on Shade.

So, Anchor is a fixed income protocol that provides a constant stream of returns. How? Anchor provides a marketplace for lending and borrowing stablecoins. By aggregating PoS block rewards and lending, Anchor is able to provide unleveraged debt-free yield. This means that any depositor into the protocol earns the rate of interest.

Let's try to break down how the mechanisms actually work. First, we need to understand how the loans operate. Any volatile illiquid collateral is assigned a lower loan-to-value ratio and therefore has less borrowing power. The opposite is true for stable liquid collateral. This naturally means that Anchor is a multi-collateral system and that borrowers can open multiple types of loans.

Then we have the staking derivatives, in Anchor's case - bAssets (bonded assets). The easiest way to explain bonded assets is to picture them as tokenized stakes (shares) of a PoS blockchain. This means that they're basically liquid derivatives that allow token holders to earn staking rewards without waiting for long unbonding periods to finish - which usually is the case for Cosmos/Tendermint chains. This unlocks a massive pool of assets, that can now be used as collateral to earn yield. These rewards then find their way back to the depositors of the Anchor protocol.

The Anchor protocol thus aggregates PoS rewards, by using block rewards from a collection of PoS assets to derive returns for the depositors. This can therefore be seen as an interest rate tied to on-chain income generated by a basket of PoS blockchain assets.

All the mechanisms are in place on Shade for a protocol like Anchor to work. Especially when you consider the plans for the ShadeDAO to accrue value from various apps on the protocol. These apps can hopefully provide a healthy ever-growing balance sheet for the ShadeDAO, wherein some of the profits could be allocated to support the APY of an Anchor-like protocol. The biggest issue of Anchor has been the constant drop of their remaining runway, which has forced the LUNA Foundation to consistently deposit large sums of UST to support the APY. If Shade can develop enough value accrual applications coupled with aggregating PoS rewards, then that can provide the consistency that an application like Anchor needs - and Shade will have the capability to build and maintain an even better version of Anchor. [10]

Partnerships

SupraOracles [11]

Oracles are used to connect external data to blockchains. This is to provide interoperability between external data feeds and smart contracts. Shade protocol is deeply reliant on an effective oracle to allow many of its applications to operate. First and foremost, is the importance of oracles in providing Silk with accurate data feeds. Silk as a stablecoin will be pegged to a basket of global currencies and commodities. As the values of these underlying currencies and commodities change, so does the target arbitrage peg price. Therefore, it is vital that the price feeds for these currencies and commodities remain accurate and secure to ensure the long-term performance of Silk as the privacy-preserving stablecoin of Web3.

Similarly, another future application of Shade Protocol - privacy-preserving synthetic assets, is attached to the value of real-world goods or digital assets. The greater the expanse of the data oracle, the greater the possibilities are for synthetic assets on Shade Protocol. Put simply, unique synthetic assets can only be available if the protocol oracle has the means to provide data feeds relating to that asset.

The importance of this partnership is summarized by Shade Protocols Lead Researcher & Economist, Carter L. Woetzel:

“Oracles will be one of the key components to Shade Protocols’ long term success. This is why SupraOracles is such a phenomenal partner: they are sharply focused on bettering speed, security, and finality to empower developers and entrepreneurs alike with the tools they need to improve their smart contracts. With SupraOracles, you can have it all — and that is what we seek for all our privacy-preserving DeFi primitives, including Silk, synthetic assets, and more to come

Band Protocol [12]

Band Protocol is another cross-chain data oracle platform. It serves the purpose of aggregating and connecting real-world data and APIs to smart contracts. Similar to SupraOracles, it will be used specifically to define the target peg for which $SILK will be arbitraged to. This target peg will be derived from an index of commodities and currencies. Therefore, price fluctuations in these currencies and commodities (depending on their respective weightings) will slowly affect the target peg price of $SILK. As previously stated, this is also vital for a range of future Shade Protocol applications - such as privacy-preserving synthetic assets.

Citadel.One [13]

Citadel.one is a non-custodial Proof-of-Stake platform used for the management and storage of crypto assets. Users can first create public addresses for all supported networks, connect their Ledger or Trezor device, or import an address generated by another wallet.

On the Citadel.one platform, users can participate in PoS consensus. for example, they can stake and delegate their assets, claim rewards, and engage in the latest network proposals. The platform also provides an analytical dashboard that displays relevant information on wallet balances and the network's main metrics. Users can also track rewards, withdrawals, transfers, and deposits across all supported networks.

Release & Airdrop

Like most Cosmos based protocols that have launched this year, $SHD was airdropped to contributors to the Cosmos and Secret ecosystems.

20% of the 14.5% airdrop allocation was airdropped on the 21st of February to incentivize testnet contributors and community members that staked on SCRT, ATOM, or LUNA from Nov 7th. — Dec 13th, 2021.

The other 80% will be claimable when the protocol launches

This helps to ensure a relatively fair launch, promoting community longevity - as users feel like they aren't being preyed upon by VCs.

Make sure to check your airdrop availabilityhere. Users must claim their airdrop within ~1 month after the main protocol launch, or their allocation will be re-distributed to the community pool. The clawback to the community pool will be incremental, and not all at once.

Roadmap

Q2 2022

Testnet | Audit | Mainnet Launch

Q3 2022

Synthetics | Listings | Partnerships

Q4 2022

Shade Protocol Application and Beyond

Where to Buy?

$SHD can currently be bought on SecretSwap and Sienna (more liquidity).

Conclusion

Shade Protocol is an experiment in building an ecosystem of privacy enabled applications built on top of the battle-hardened privacy smart contracts of Secret. The first project is the privacy-enabled stablecoin Silk. Shade, if successful, stands to become the first protocol with a purpose-built suite of interconnected, privacy-preserving dApps - all accruing value to the SHD token. As a result of these value accrual mechanisms, the ShadeDAO will also become the world’s first privacy-preserving decentralized balance sheet. There are many comparisons to LUNA/UST, and we all know how well that continues to turn out, so the future certainly looks bright for Shade - as long as they can avoid blunders, and if Secret can handle all the traffic.

References

https://medium.com/@shadeprotocoldevs/what-is-shade-protocol-efc1ef7aeabf

https://medium.com/terra-money/stablecoins-defining-the-terra-algorithmic-design-5d952fdf68d

https://medium.com/@shadeprotocoldevs/shade-protocol-tokenomics-833567473635

https://medium.com/@shadeprotocoldevs/shade-protocol-partners-with-supraoracles-115677782657

https://medium.com/citadel-one/shade-protocol-overview-ed49282616ca

The article is written in collaboration between @0xRainandCoffee and @intern_mikey.

Mikey's Substack can be found by clicking the link underneath.

Thanks for the indulgence!

This is well written article, concise and detailed. It explains with simplicity what Shade Protocol entails and the network, $SCRT, supporting it. Very insightful.